Titan: The Aggregator of Aggregators on Solana

So you want to swap some tokens on Solana. You go to a DEX, hit swap, done. But did you get the best price? Probably not. That's why DEX aggregators exist. They check multiple exchanges and route your trade through whatever combination gives you the most tokens back.

But what if the aggregator you picked isn't finding the best route either?

Titan's answer: aggregate the aggregators.

Problem

When you trade on a single DEX like Orca or Raydium, you're limited to the liquidity on that one venue. A DEX aggregator like Jupiter improves on this by checking multiple DEXs and splitting your trade across them to get a better rate.

The problem is that each aggregator has its own routing algorithm, its own data sources, its own way of splitting trades. Jupiter might find the best route for one swap but miss it on the next. No single aggregator wins every time.

On top of that, quotes can be stale. Crypto moves fast. By the time an aggregator shows you a price, the actual on-chain state might have shifted. You think you're getting one rate, you sign the transaction, and the execution is different.

Solution

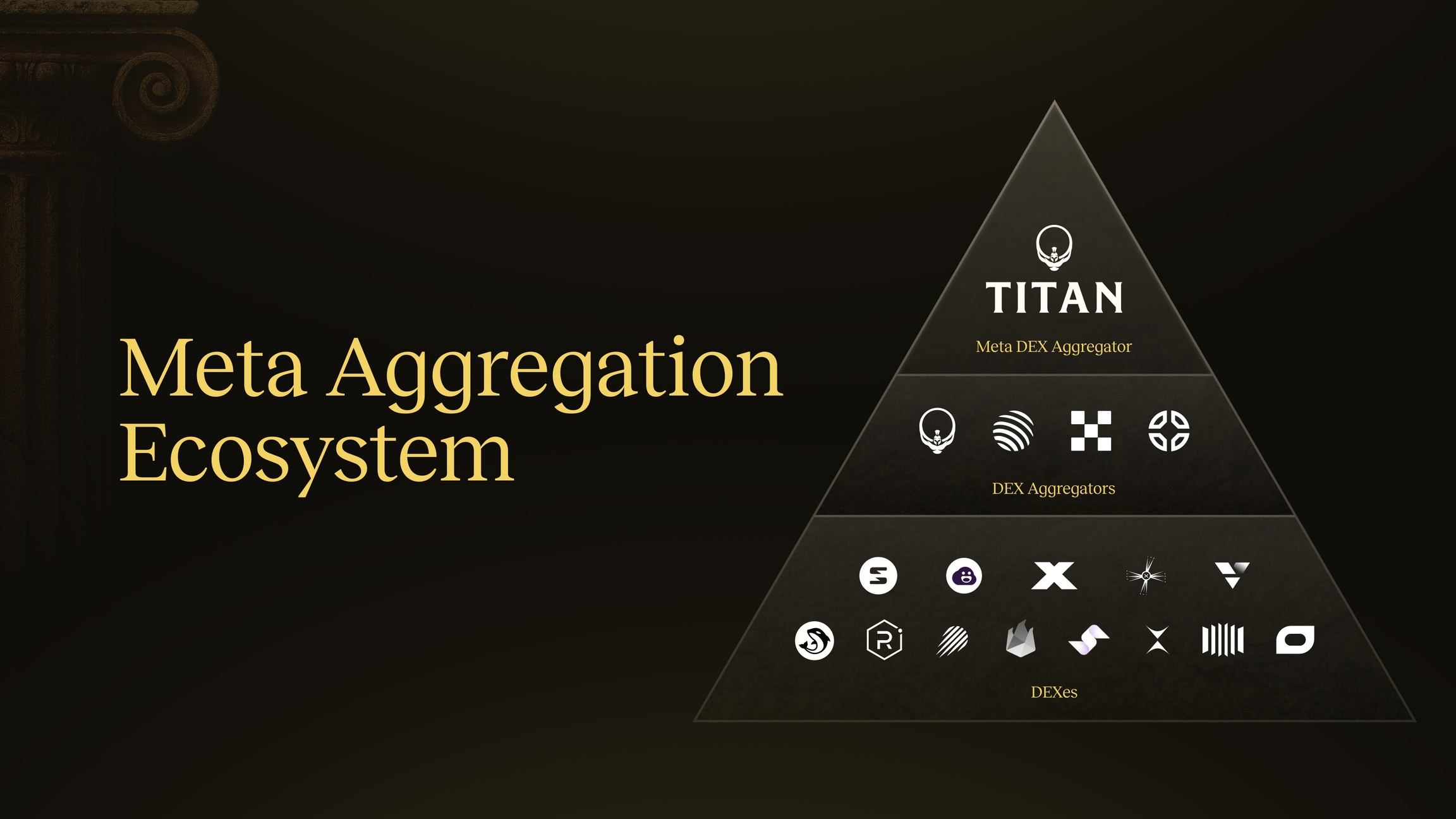

Titan sits one layer above the aggregators. They call it meta-aggregation. Instead of running its own routing algorithm in isolation, Titan pulls quotes from multiple DEX aggregators, compares them, and gives you the winner.

Think of it like this (they use this analogy in their docs):

- A DEX is like an exchange

- A DEX aggregator is like a market maker

- Titan is the broker that shops across all the market makers for you

How it actually works

Argos routing. Titan doesn't just compare other aggregators passively. They have their own routing algorithm called Argos that competes alongside them. They claim it finds better prices about 80% of the time on its own. So it's both a competitor and a comparator at the same time.

Then there's the on-chain simulation part, which imo is the most interesting bit. Titan simulates every quote directly on the blockchain, on the same block. Why does that matter? Because comparing a Jupiter quote from 2 seconds ago with another aggregator's quote from right now is comparing apples to oranges. Same-block simulation means the comparison is actually fair. It also catches aggregators that estimate prices instead of simulating them.

They also have something called Titan Prime which auto-tunes your slippage and transaction settings for better landing rates. Less knobs to fiddle with basically.

Why Solana specifically

This only works on a cheap chain. On Ethereum you'd spend more on gas than you'd save from the routing optimization lol. On Solana, transactions cost fractions of a cent. So simulating a bunch of aggregator routes, comparing them on the same block, picking the winner? Costs almost nothing. You just get a better price.

That's also why Solana has so many DEXs and aggregators in the first place. Cheap transactions mean liquidity is distributed across tons of venues. More venues = more potential routes = more value in having something that actually compares them all.

No token, no fees

Titan doesn't have a token and the meta-aggregation layer charges zero fees. The quote you see is the quote you get. They're betting on volume and eventually an API for systematic traders and integrations.

Conclusion

Aggregating DEXs was a good idea. Aggregating the aggregators is the natural next step. If one aggregator can miss the best route, why not just compare all of them?

The same-block simulation is what separates this from just showing multiple quotes in a dashboard. It's a real apples-to-apples comparison, not five numbers from five different moments.

Can Titan keep that 80% win rate as Jupiter and others improve their routing? I don't know. But on Solana where extra computation is basically free, there's no real downside to having another optimization layer on your swaps.