Liquid Staking on Solana: Sanctum and INF

If you hold SOL and you're not staking it, you're leaving money on the table. That's just how PoS works. You lock up your tokens, help secure the network, get paid for it. But regular staking has an annoying tradeoff: your SOL is locked. You can't trade it, use it in DeFi, or do anything with it until you unstake (which takes a few days on Solana).

Liquid staking fixes that.

Problem

Regular staking on Solana means you pick a validator, delegate your SOL, and wait. You earn ~7% APY which is nice. But that SOL is stuck. Need to sell? Unstake and wait. Want to provide liquidity on a DEX? Can't, it's delegated.

This is where LSTs come in. You deposit SOL into a stake pool, get a token back that represents your staked position, and that token goes up in value over time as staking rewards accumulate. You can trade it, use it as collateral, whatever. Your SOL is staked AND liquid at the same time.

Sounds great right? It is. But there's a catch.

There are over 1,000 LSTs on Solana now. Up from like 5 a couple years ago. Some are from big validators, some from tiny ones. Liquidity is fragmented everywhere. If you hold some random validator's LST and want to swap it to SOL, you might get bad rates or not find liquidity at all. And picking the "best" LST? Good luck comparing yields across hundreds of options.

Solution

Sanctum basically said "what if all these LSTs could talk to each other." They built the infrastructure to make that happen.

The Infinity Pool

The core product is called Infinity. It's a multi-LST liquidity pool that holds a diversified basket of high-performing LSTs. Instead of picking one validator or one LST and hoping for the best, Infinity spreads across many of them.

When you deposit SOL into Infinity, you get back INF. It's a regular SPL token that just sits in your wallet. No claiming rewards, no restaking, no maintenance. The token itself goes up in value relative to SOL as staking rewards and fees accumulate in the pool.

Where the yield comes from

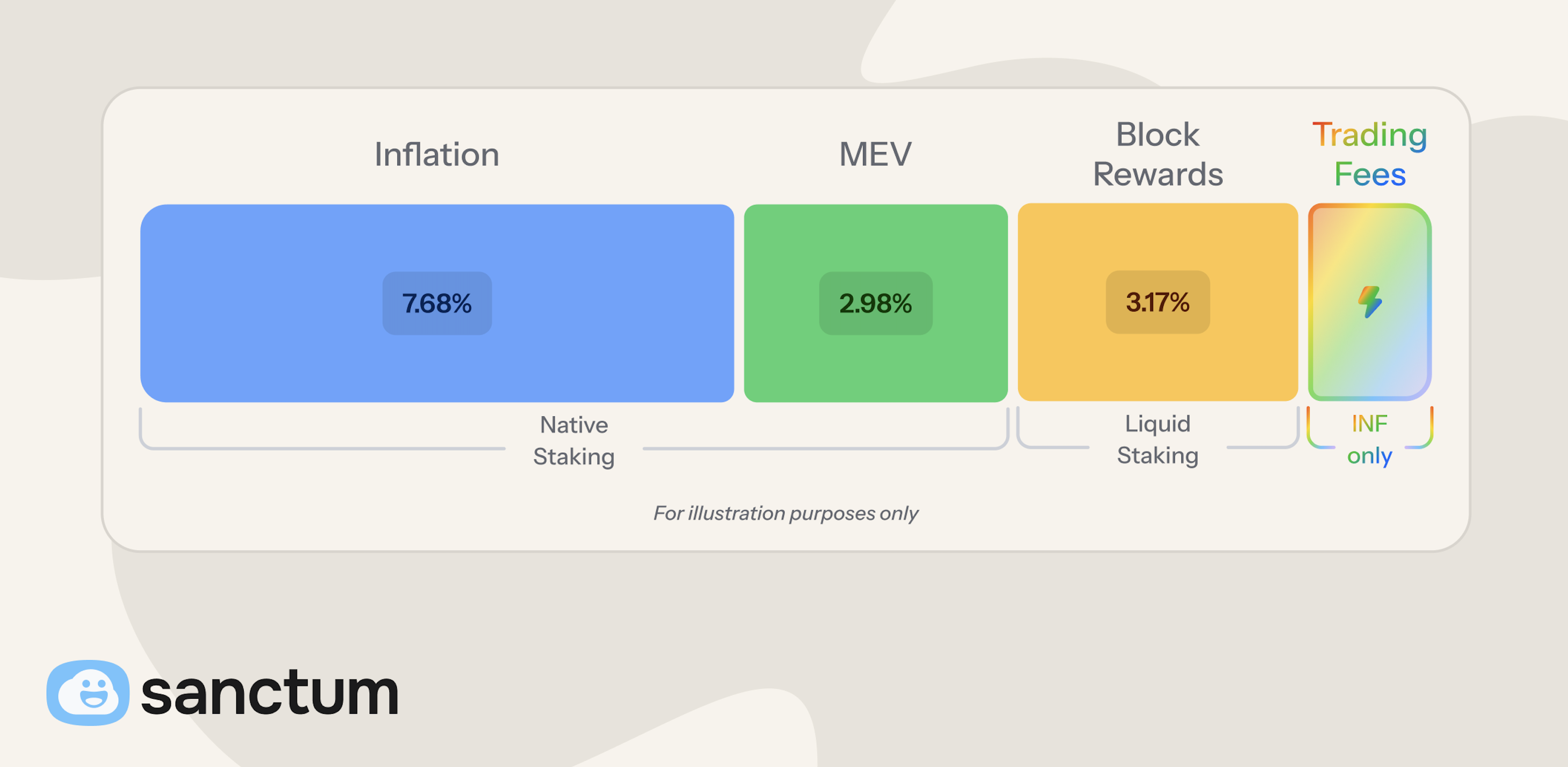

INF earns from two sources:

- Staking rewards. The basket of LSTs inside Infinity all earn their own staking, MEV, and block rewards. That yield flows into the pool

- Trading fees. This is the part that's unique to INF. Infinity acts as a router for LST-to-LST swaps. Someone wants to swap their jitoSOL for bSOL? Infinity can handle that trade at zero slippage (because it knows the exact on-chain exchange rates for each LST). It charges a small fee for the swap, and that fee goes to INF holders

No other LST on Solana does both. You're earning staking yield plus a cut of every LST trade that flows through the pool.

Zero slippage trading

This part is clever. Most DEXs use a constant-product formula to price trades, which means bigger trades get worse prices. Infinity doesn't do that. It reads the on-chain exchange rates directly from each stake pool program, so it knows exactly what each LST is worth in SOL terms. A trade of 10 SOL gets the same rate as a trade of 10,000 SOL. Zero price impact.

This is why Jupiter and other Solana aggregators route LST swaps through Sanctum. It's just better pricing.

CLOUD

Sanctum also has their own governance token, ![]() CLOUD 80.0%. It's the token for the broader Sanctum ecosystem. Different from INF which is the yield-bearing LST. CLOUD is for governance and aligning incentives across the protocol.

CLOUD 80.0%. It's the token for the broader Sanctum ecosystem. Different from INF which is the yield-bearing LST. CLOUD is for governance and aligning incentives across the protocol.

How to get INF

Pretty simple:

- Go to Sanctum's app

- Deposit SOL (or any LST you already hold)

- Get INF back. 0% deposit fee, 0% price impact

- Hold it. That's it

You can also just swap for INF on Jupiter or any Solana DEX. Once you have it, rewards accumulate automatically. No lockups, no epochs to wait for, no claiming buttons.

Conclusion

Liquid staking went from a niche thing to over 40 million SOL locked up across the Solana ecosystem. Sanctum's bet is that unifying all that fragmented liquidity under one roof (and one token) is better than everyone running their own isolated pools. The numbers so far back that up, with over 2 million SOL secured and three independent audits.

IMO the zero-slippage LST trading is what makes this interesting beyond just "another staking protocol." It turns Infinity into actual infrastructure that the rest of the ecosystem routes through. And INF holders get paid for that.

If you're holding unstaked SOL, ngl, you should at least look into it.